Ford goes "ALL IN" poker style!

On Monday, Ford Motor Company (ticker symbol: F) announced that it had mortgaged its assets for a coporate version of a "home equity loan". The collateralized terms for the loan, which yields the firm $18 billion, includes nearly all of Ford's domestic assets - its plants, office buildings, patents and trademarks along with equity stakes in Ford Motor Credit and Volvo. It appears as though they are earmarking these funds to cushion against softer upcoming sales and a potential strike with the UAW. The key components of the new financing includes an $8 billion five-year senior secured revolving facility, a $7 billion senior secured term loan and a $3 billion issue of convertible debt. Here are a few more notes:

1. The new liquidity should provide protection against bankruptcy for about 2 to 3 years.

2. Provide a cushion in the event of a strike. The negotiations with the UAW are expected to begin in 4Q07.

3. Management believes that the company will probably not turn a profit until 2009.

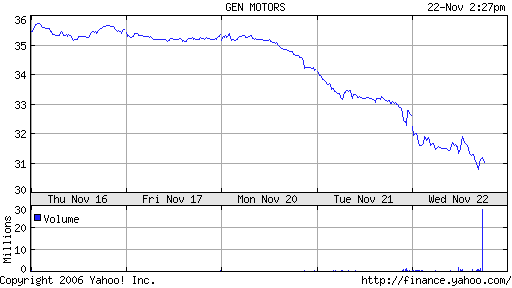

Recently, I was what my thoughts are regarding Ford. Well, in light of the said facts, I certainly feel that you might be best looking for opportunity elsewhere. Historically, auto stocks have really been a bad investment in terms of capital appreciation. Union demands, stronger market competition, escalating wages/benefit costs, poor engineering and a host of other concerns make this automaker a stock to avoid.

Did you know? The average Ford manufacturing line worker gets paid over $55 per hour (pay + benefits) while the average US manufacturing worker gets paid approx $25 per hour (pay + benefits). Is there a disconnect here?