Some quick notes on China and FXI:

VISIBILITY IS A PROBLEM - And this is due to three reasons: (1) the US credit crisis has spilled over to global debt markets; (2) China's economy may be overheating; and (3) companies' earnings and liquidity in the equities markets. With that in line, Chinese stocks have seen some weakness as investors are pricing in the expectations of lower shareholder returns and high equity risk premium which is a bi-product of outlook uncertainties.

IMPORTING GROWTH - The Chinese have been "importing" global growth by exporting Chinese produced goods. These goods include everything from steel, copper to other often used commodities around the world. Basically, the products that fuel economic growth. However, in times of slowing global growth, China may act to help alleviate global weakness by trying to sustain long term growth which means that at some point they need to accept some moderating of their torrid growth pace.

TIGHTENING THE CREDIT MARKETS - This may also mean tightening lending standards. Investment projects in China are likely to face headwinds when they apply for approvals and bank credits. When exports falter and signs of slowing in investment growth appear then imbalances in credit and hypergrowth should better align themselves.

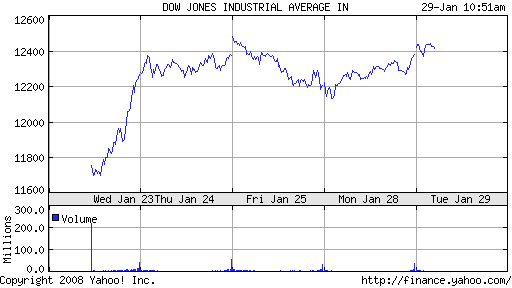

I still believe that over a 12 month time frame, FXI remains an excellent longer term choice (12 month plus). I would caution investors trying to day trade the stock or play on a very short term basis. The equity markets in China are super-volatile as compared to the US markets. Not sure most of us would have the stomach to see broader market numbers moving 10 to 12% on a daily basis as we saw last week on Asian exchanges.